- Authentication is required… When adding a payment card to a mobile wallet it must pass an authentication process – most times this authentication process will require you to call your payment card’s financial institution for further authentication as a final step.

- Lock screens and payment locks are required… Mobile wallet apps require a lock screen to be set-up on your smartphone. With all the sensitive data on your smartphone, Share Advantage always recommends having a lock screen on your smartphone whether you have a mobile wallet or not. Additionally, the mobile wallet app itself many times will have an additional payment lock which will require a similar set-up to your smartphone’s lock screen. Mobile wallet payment locks may be PIN, facial or fingerprint recognition. Mobile wallet payment locks require unlocking to make a payment.

- Your original card number is tokenized... While your physical debit card, original debit card number, and your 24-hour daily debit card limits will work as usual, mobile wallet payments use industry-leading security technology called tokenization. Tokenization protects your original card number by creating a new, random 16-digit card number in place of your original card number. Tokenization security has proved itself better than encryption security. Once a payment card is added to your mobile wallet, a new tokenized card number is created to make mobile wallet payments. The tokenized card number is printed on merchant receipts. In the event a merchant asks for the last-four digits of your card number, you will give them the last-four digits of the tokenized card number. The last-four digits of the tokenized card number can be found under the card's details in your mobile wallet. In Apple Wallet® the tokenized card number is called a device account number; in Google Wallet™, it is called a virtual account number; in Samsung Wallet®, it is called a digital card number. The last-four digits of the original card number will remain visible in your mobile wallet for your reference only.

- Each payment is layered with dynamic data… On top of each mobile wallet payment dynamic data is layered. Unique dynamic data, like a transaction counter and more, is layered on to each payment to help authenticate the current payment and future payments. Dynamic data helps prevent the payment information from being reused if ever intercepted while the payment is in-transit or due to a merchant database breach by hackers.

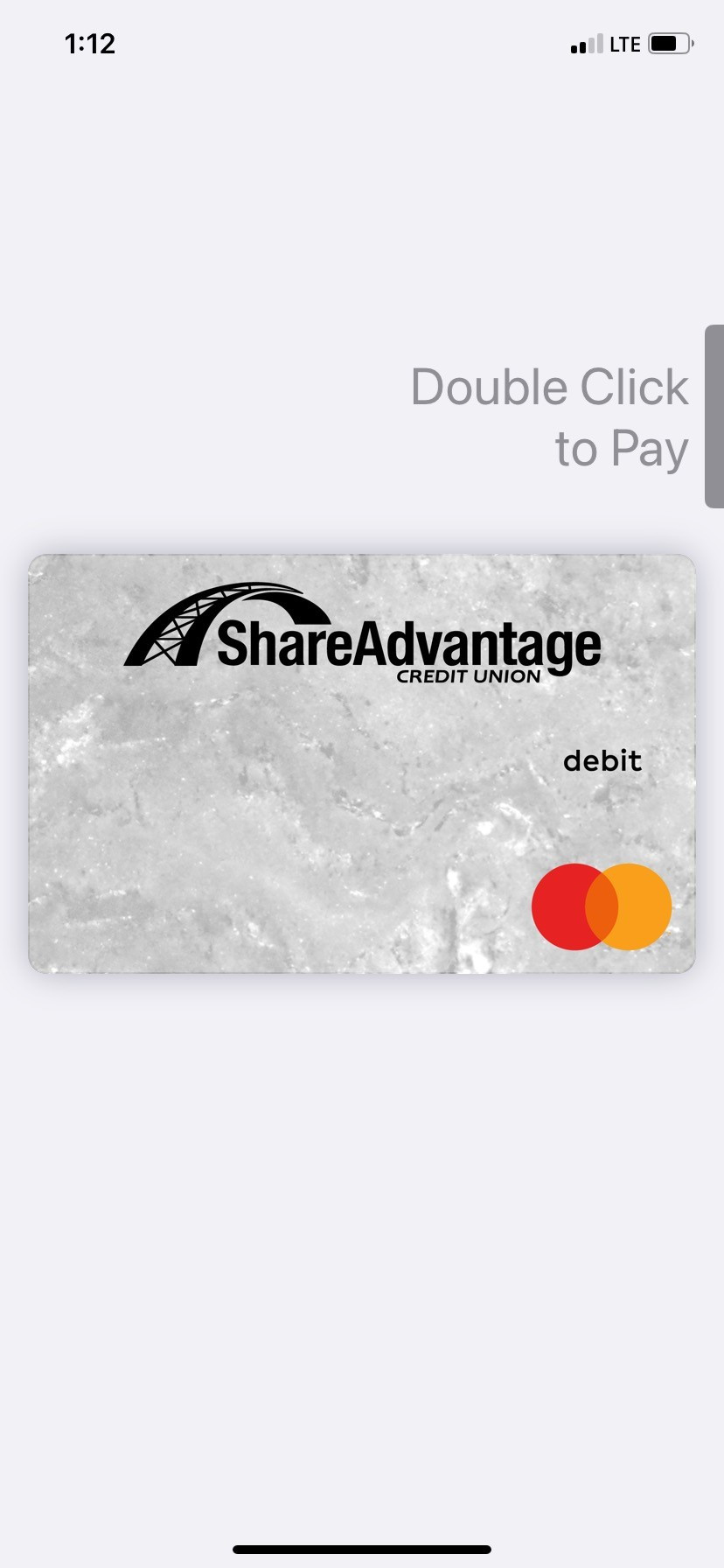

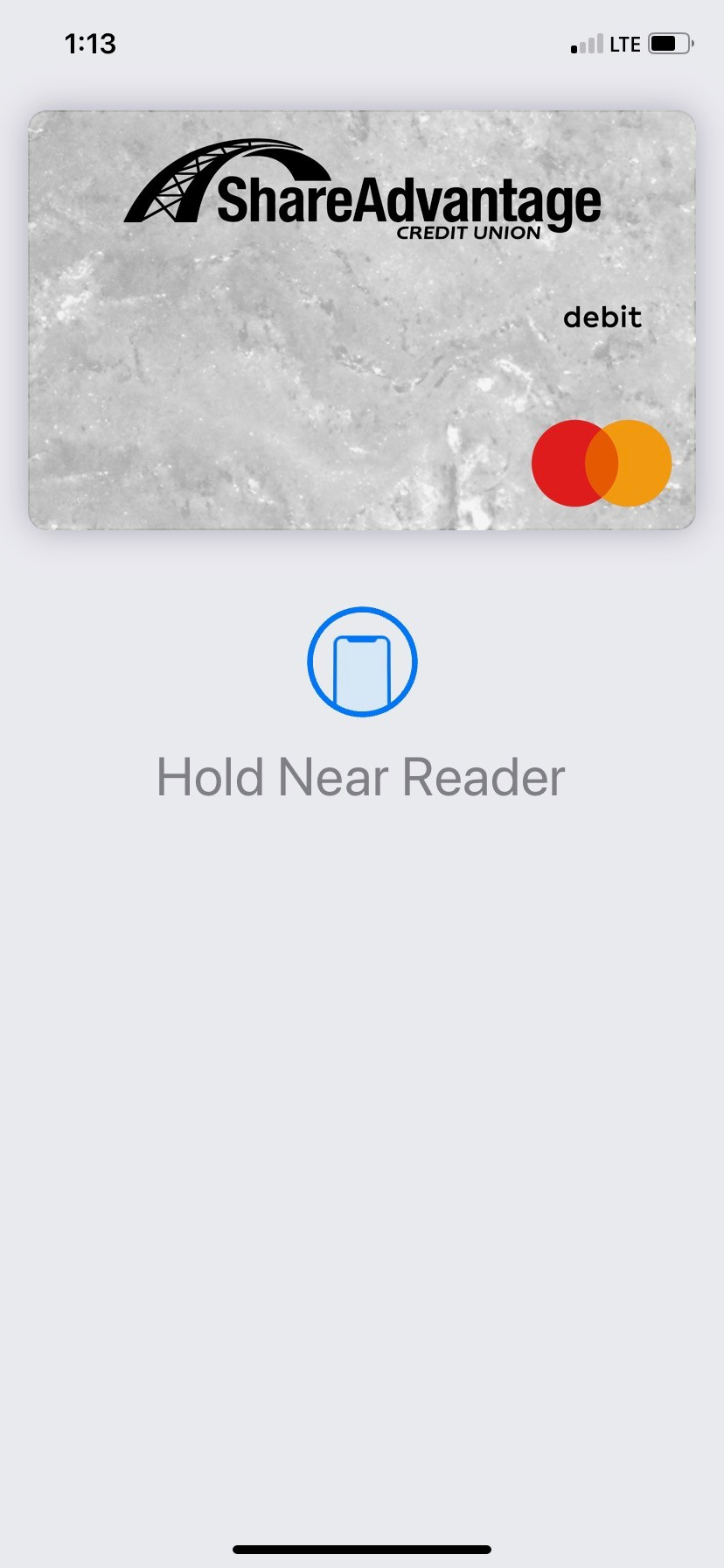

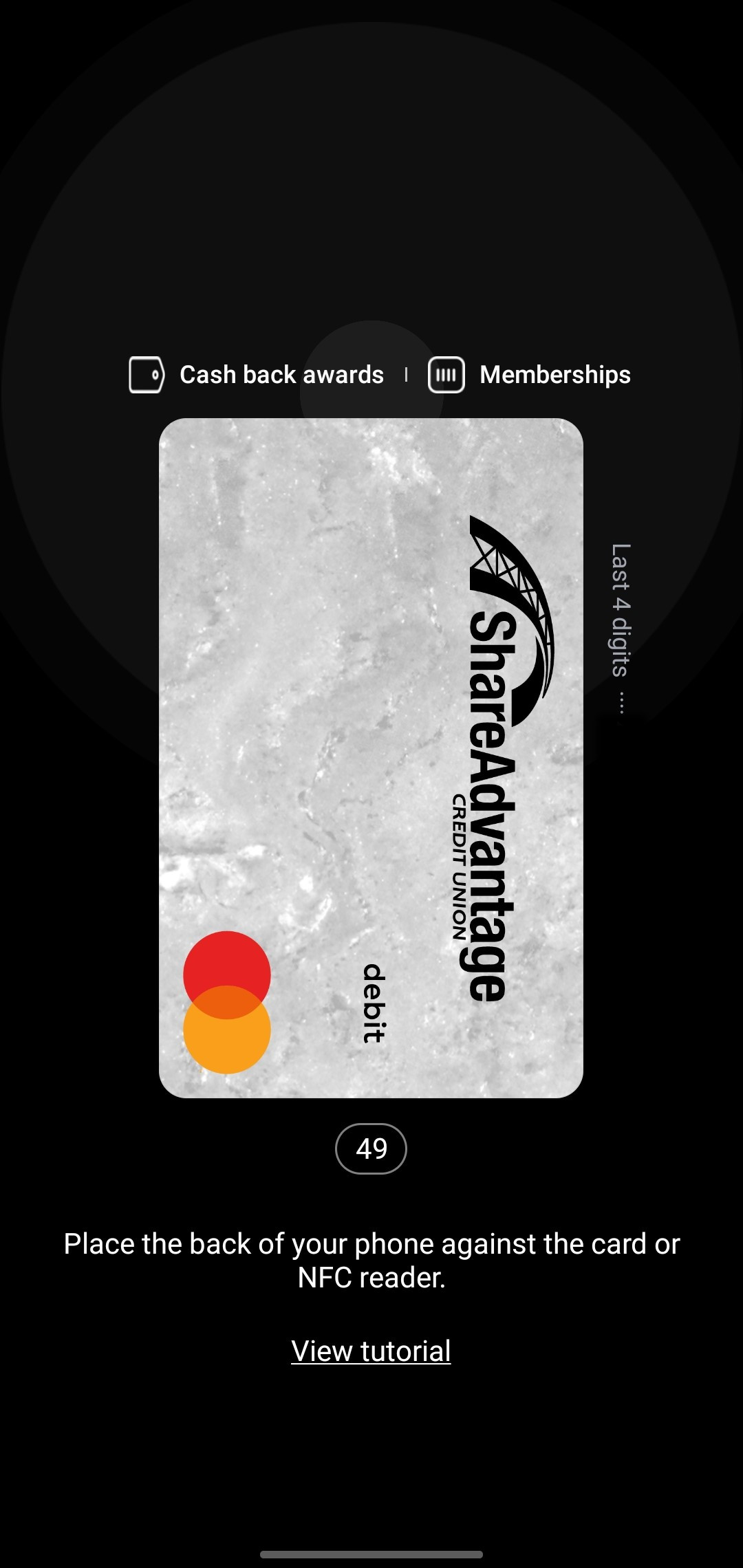

- Payments at lightning speed… Payments with your mobile wallet are ultra-secure, ultra-fast, touchless, and do not require the physical card to be present. In-person payments are started by unlocking your smartphone or smart device and selecting the appropriate payment card in your mobile wallet. If your mobile wallet requires you to unlock the card to make the payment, it will offer you the unlock feature you set-up for your mobile wallet. Unlocking the card for payment activates the card for a limited time. You may feel your smartphone begin to vibrate and a countdown timer may appear on the screen. Once placed near the card reader, you may hear a ding or feel a vibration and a checkmark will appear on the screen confirming your payment was successfully made.

- Online and in-app payments… If you are on the device or one of the devices that you activated Apple Pay or Google Pay/G Pay on, you can securely and quickly checkout on any merchant’s website or app that offers Apple Pay or Google Pay/G Pay as a secure payment option.

- Identity security… Little to no consumer identity information accompanies mobile wallet payments. Because of this, merchants rarely store mobile wallet information. This limits your identity being put at risk if the merchant experiences a database breach by hackers.

Mobile Wallets

"Any sufficiently advanced technology is indistinguishable from magic!"

-Arthur C. Clarke

Your SACU DEBIT Card is now mobile wallet ready!

If your mobile wallet states that your debit card requires further authentication, please call us at 218-722-5931 Monday-Friday during business hours; authentication cannot be done outside of business hours. You can also call us to remove your debit card from your mobile wallet. In the event you need your debit card CLOSED IMMEDIATELY, please call 1-833-462-0798 24/7.

What are mobile wallets?

If you’ve seen someone tap their smartphone at the checkout in-store or seen the ability to check out on a merchant website or app securely with Google Pay™/G Pay™ or Apple Pay® – you’ve seen the growing popularity of mobile wallets in action.

Mobile wallets are free, industry-leading, secure apps from tech leaders like Apple®, Google, and Samsung® that are available for download on your smartphone, or smart device like a Fitbit or Garmin smartwatch. Mobile wallets allow you to add payment cards, membership cards, and transit cards into a secure digital wallet. Mobile wallet payments layer industry-leading security measures to protect your original card number and consumer identity information while completing payments at lightning speed. Mobile wallets help minimize the need to carry multiple physical cards and eliminate the need to handle or hand over your cards.

Where can I use a mobile wallet?

You can use your mobile wallet anywhere contactless, Near Field Communication (NFC) payments are accepted. This is usually listed on the merchant’s door or near the card reader at checkout.

NFC

Alternatively, your mobile wallet’s corresponding “Pay” feature may be featured on the merchant’s accepted payments display (ex: Apple Pay®, Google Pay™/G Pay™, or Samsung Pay®). Because mobile wallets aren’t accepted everywhere, and technology can fail from time to time, Share Advantage always recommends carrying multiple payment methods including an additional physical card and cash.

If you are not sure if the business you are at accepts mobile wallet payments, simply ask the cashier if they accept your specific mobile wallet payment (ex: Apple Pay, Google Pay/G Pay, or Samsung Pay). If the cashier isn’t sure, ask if you can give it a try. Most cashiers are game for the test because they won’t have to handle your physical card or cash.

We’ve found the Northland is adapting quickly to accept mobile wallets at most businesses, even small businesses. Here are some businesses we’ve found that accept mobile wallets locally (each location may vary and the specific wallets they accept may vary): Kwik Trip in-store and pay at the pump, Cub Foods, Super One Foods, Walgreens, Subway, Jersey Mikes, Taco Johns, Burger King, McDonalds, Bath & Body Works and so many more.

INDUSTRY-LEADING SECURITY: From adding a card to making a payment

INDUSTRY-LEADING SECURITY:

From adding a card to making a payment

What happens when I get my renewed card with a new expiration date, or I get a new card number?

Simply add the updated or new card to your mobile wallet and a new tokenized card number will be created. Before deleting the old, tokenized card number, be sure no returns will need to be made with that number.

What happens if I need to make a return?

The degree to which merchants can look up previous payments using a mobile wallet may vary. Merchants may use the tokenized card number that made the purchase or require a receipt. In the event a merchant asks you the last-four digits of the card number, you will give them the last-four digits of the tokenized card number. The last-four digits of the tokenized number can be seen by going into the card’s details within the mobile wallet. In Apple Wallet the tokenized card number is called a device account number; in Google Wallet, it is called a virtual account number; in Samsung Wallet, it is called a digital card number. IMPORTANT: Full card numbers are not revealed in mobile wallets. Mobile wallet payments are made with the tokenized card number. The last-four digits of the original card number will remain visible in your mobile wallet for your reference only.

What if my device is lost or stolen?

Many smart devices feature services to help remotely find, remotely lock, and/or remotely erase them. These remote services typically require you to register your device with its remote feature prior to any need or event. Share Advantage highly recommends registering your devices with such services in case you ever need them. Find My™ device for Apple iPhones and Apple devices or Find My Mobile® for Samsung smartphones and Samsung smart devices are such examples. You can also call us at 218-722-5931 Monday-Friday during business hours to have your card removed from your mobile wallet. None of these prior steps will affect your ability to use your plastic card. In the event you need your debit card CLOSED IMMEDIATELY, please call 1-833-462-0798 24/7.

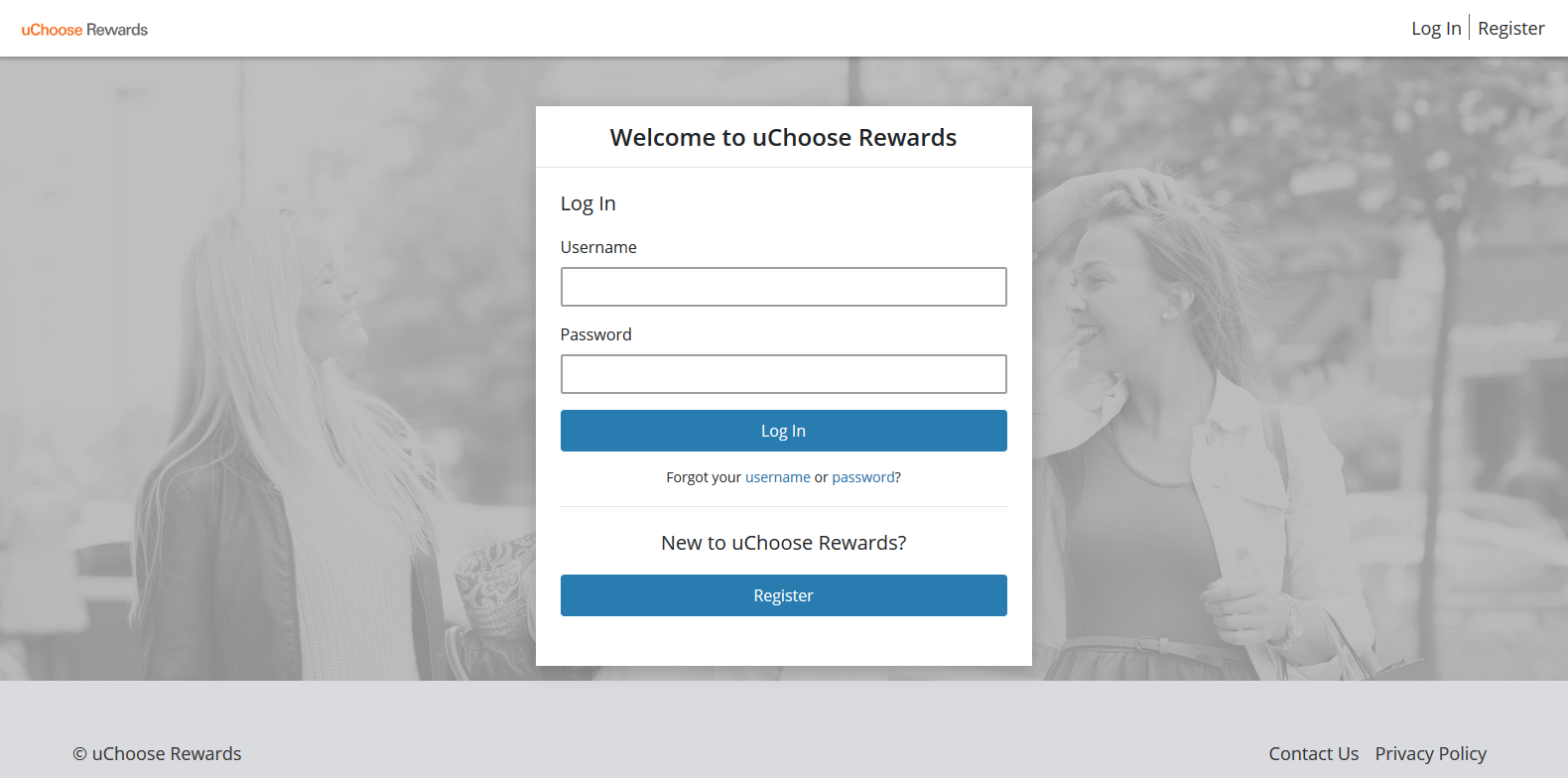

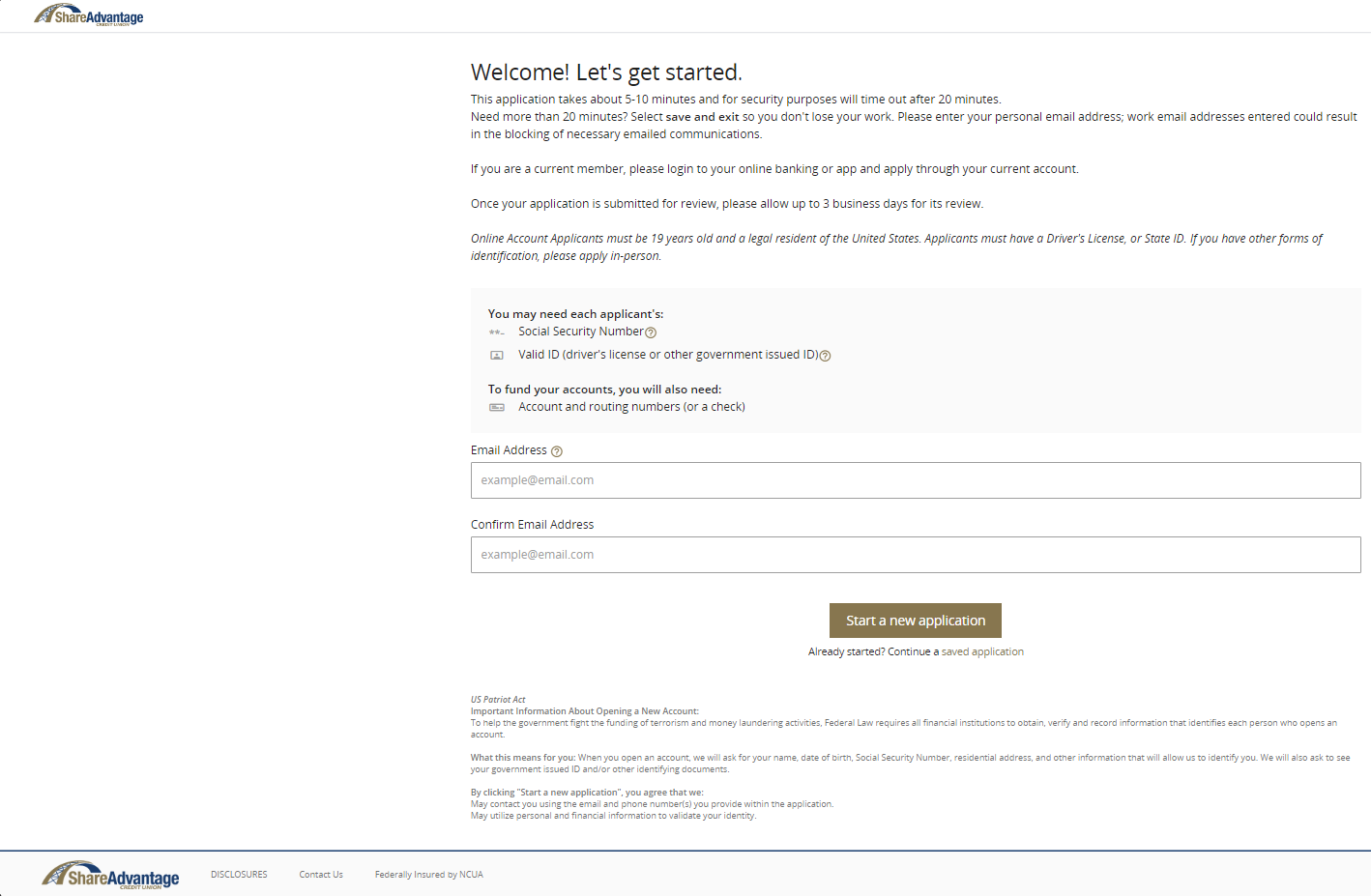

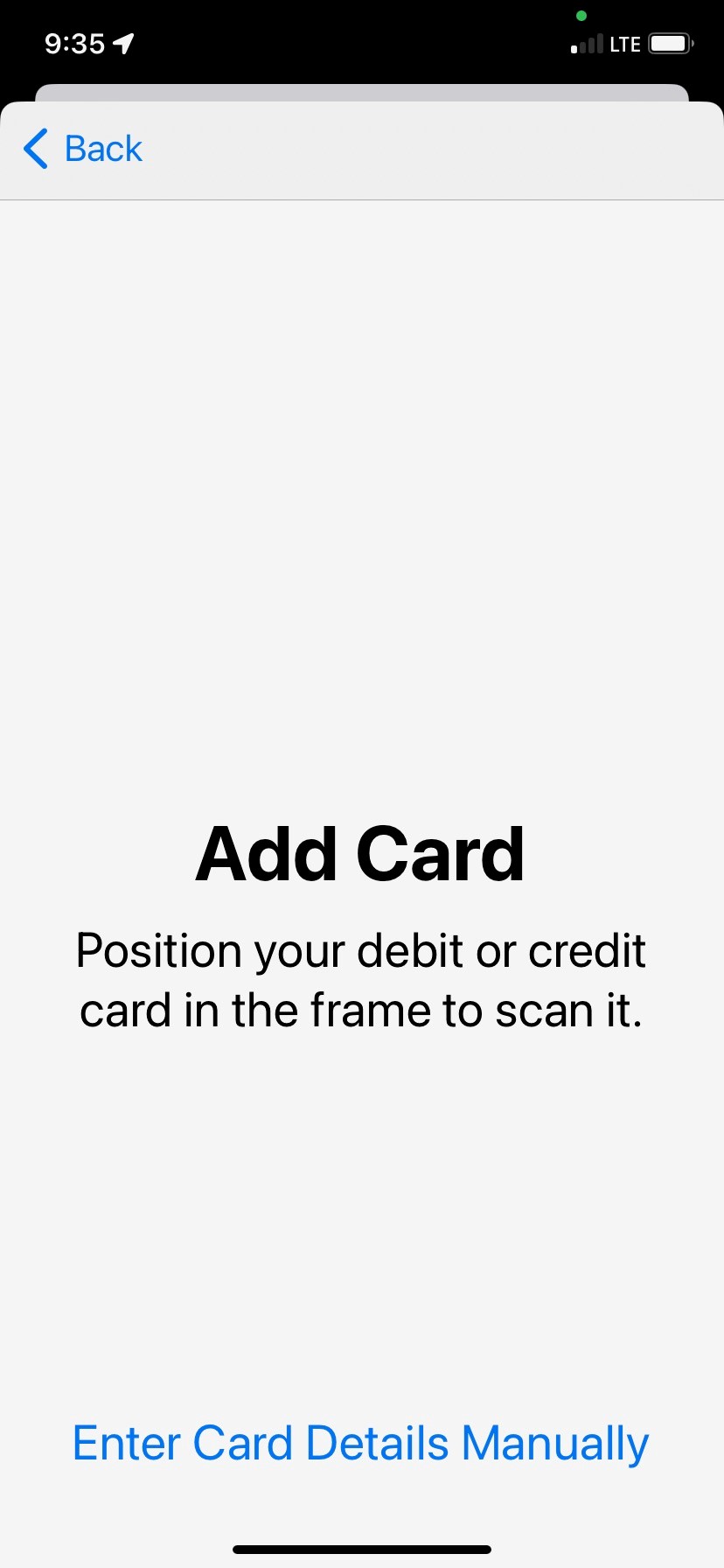

- Your SACU Debit Card will work with Apple Wallet® on iPhones®.

- Download Apple Wallet from the Apple App Store®. Apple Wallet may come pre-loaded on new iPhones.

- Payment cards loaded into Apple Wallet use Apple Pay® in-store, online, and in-app to perform ultra-secure payments.

HOW TO… Apple Wallet

If asked to call us to further authenticate, please call us at 218-722-5931 Monday-Friday during business hours; authentication cannot be done outside of business hours.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Note: Some screens may appear different or be omitted from this example. Adding your card using your smartphone’s camera or manually and accepting the wallet’s Terms & Conditions are standard.

- Your SACU Debit Card will work with Google Wallet™ on Android™ smartphones.

- Download Google Wallet from Google Play™ store.

- Payment cards loaded into Google Wallet use Google Pay™ in-store, online, and in-app to perform ultra-secure payments.

- Watch a video on Google Wallet

HOW TO… Google Wallet

If asked to call us to further authenticate, please call us at 218-722-5931 Monday-Friday during business hours; authentication cannot be done outside of business hours.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Note: Some screens may appear different or be omitted from this example. Adding your card using your smartphone’s camera or manually and accepting the wallet’s Terms & Conditions are standard.

- Your SACU Debit Card will work with Samsung Wallet® on Samsung® smartphones.

- Download Samsung Wallet from the Samsung Galaxy Store™ or Google Play store. Samsung Wallet may come pre-loaded on new Samsung smartphones.

- Payment cards loaded into Samsung Wallet use Samsung Pay® in-store to perform ultra-secure payments.

HOW TO… Samsung Wallet

If asked to call us to further authenticate, please call us at 218-722-5931 Monday-Friday during business hours; authentication cannot be done outside of business hours.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Note: Some screens may appear different or be omitted from this example. Adding your card using your smartphone’s camera or manually and accepting the wallet’s Terms & Conditions are standard.

- Your SACU Debit Card will work with Garmin Pay™ on Garmin® smart watches.

- Download Garmin Connect™ from the Google Play or Apple App Store.

- Garmin Connect allows you to add a payment card to Garmin Pay.

- Learn more about Garmin Pay

HOW TO… Garmin Pay

If asked to call us to further authenticate, please call us at 218-722-5931 Monday-Friday during business hours; authentication cannot be done outside of business hours.

Note: Some screens may appear different or be omitted from this example. Adding your card using your smartphone’s camera or manually and accepting the wallet’s Terms & Conditions are standard.