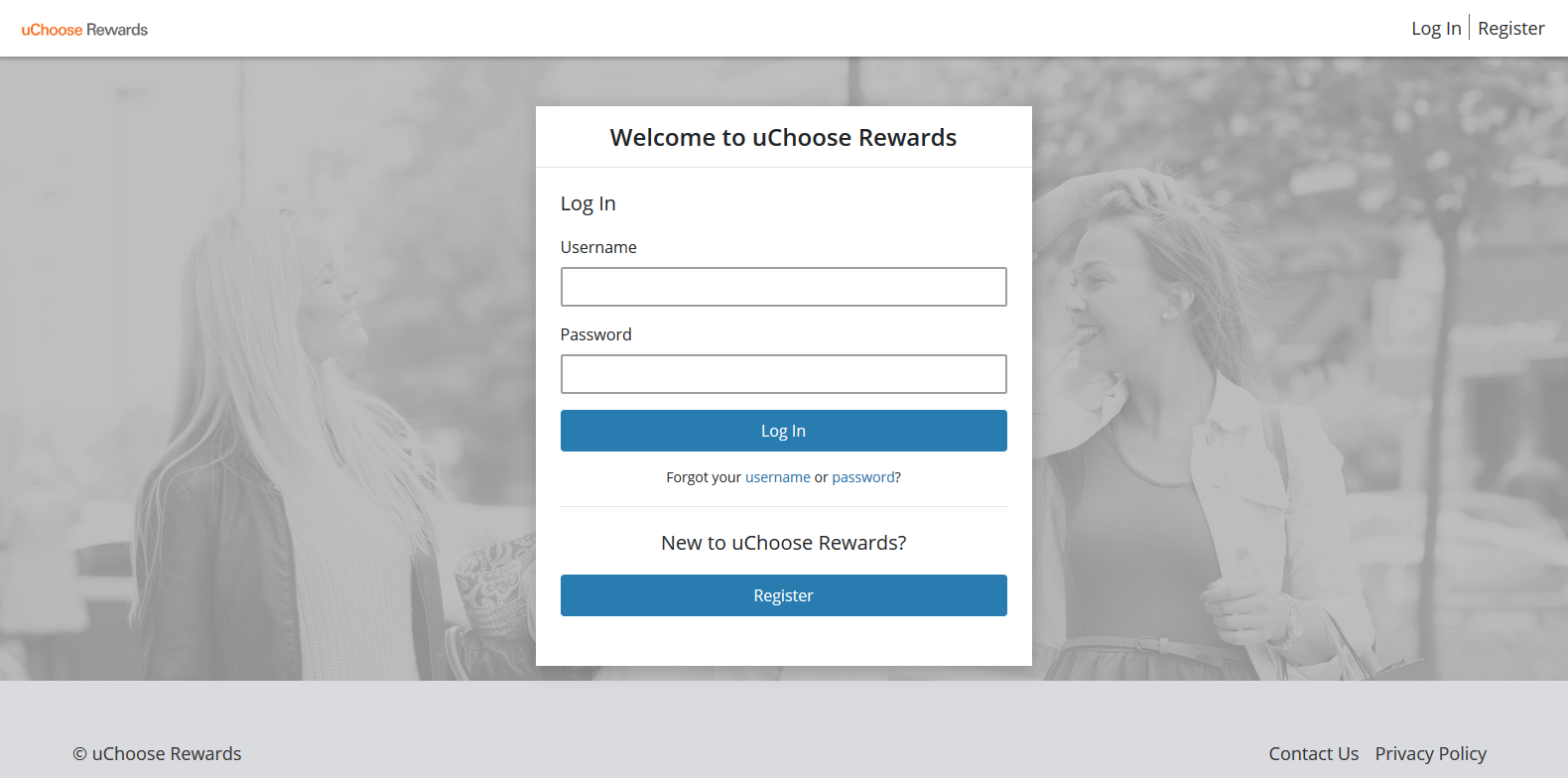

You are about to leave myshareadvantage.com.

You are navigating to VISA®'s uChoose Rewards website for the Advantage Rewards Credit Card at www.uchooserewards.com

Sharing the advantages of saving for tomorrow

| SAVINGS & CHECKING | MIN DEPOSIT | APY* |

|---|---|---|

| Regular Share - Average Daily Balance | ||

| $25.00 - $5,000.00 | $10.00 | .05% |

| $5,000.01 - $25,000.00 | $10.00 | .05% |

| $25,000.01 and Greater | $10.00 | .10% |

| Youth Account1 (up to 18 Years of Age) | $5.00 | .15% |

| Other Share2 - Average Daily Balance | ||

| $25.00 - $5,000.00 | NA | .05% |

| $5,000.01 - $25,000.00 | NA | .05% |

| $25,000.01 and Greater | NA | .10% |

| Money Market3 - Average Daily Balance | ||

| $0.00 - $10,000.00 | $2,000.00 | .15% |

| $10,000.01 - $20,000.00 | $2,000.00 | .15% |

| $20,000.01 and Greater | $2,000.00 | .20% |

| Other Savings | ||

| Holiday Club4 | NA | .30% |

| Mortgage Escrow Account | NA | .05% |

| Checking | ||

| Checking | NA | 0.00% |

| Youth Checking1 (ages 15-18) | NA | 0.00% |

| Business Checking5 | NA | 0.05% |

| Investment - Average Daily Balance | ||

| Traditional IRA** | $100.00 | .20% |

| Roth IRA** | $100.00 | .20% |

| CDs / CERTIFICATES OF DEPOSIT | MIN DEPOSIT | RATE / APY* |

|---|---|---|

| Time Share | ||

| 6 Month | $500.00 | .35% / .35% |

| 12 Month | $500.00 | 1.00% / 1.00% |

| 24 Month | $500.00 | 1.05% / 1.05% |

| 36 Month | $500.00 | 1.10% / 1.10% |

| 48 Month | $500.00 | 1.20% / 1.21% |

| Traditional IRA** | ||

| 6 Month IRA | $500.00 | .35% / .35% |

| 12 Month IRA | $500.00 | 1.00% / 1.00% |

| 24 Month IRA | $500.00 | 1.05% / 1.05% |

| 36 Month IRA | $500.00 | 1.10% / 1.10% |

| 48 Month IRA | $500.00 | 1.20% / 1.21% |

| Roth IRA** | ||

| 12 Month IRA | $500.00 | 1.00% / 1.00% |

| 24 Month IRA | $500.00 | 1.05% / 1.05% |

| 36 Month IRA | $500.00 | 1.10% / 1.10% |

| 48 Month IRA | $500.00 | 1.20% / 1.21% |

| DIVIDEND COMPOUNDING AND CREDITING | CREDITED |

|---|---|

| All Savings Account Types | Monthly |

| All CD Types | Quarterly on CD’s anniversary date |

* APY = Annual Percentage Yield

** IRA = Individual Retirement Account. Withdrawal and contribution limitations apply.

1 Minors require an adult joint on accounts. Membership eligibility required of either minor or joint. Minors need not be present, but we encourage their participation. Savings accounts are available for newborns as early as their Social Security Number is issued. Checking accounts are available for ages 15-18 and include a FREE lower-limits Debit Card and Apps. Joint(s) with their own Membership(s) can oversee the Youth's Account activity from within their Online Banking. Available Upon Request: extra-low Debit Card limits.

2 Multiple Other Share accounts can help budgeting & saving for goals by keeping funds separate.

3 If the Money Market falls below the $2,000 minimum, the interest/dividend will be reduced to that of a Regular Share/Savings.

4 Holiday Club accounts allow for limited withdrawals: Funds automatically transfer into the Regular Shares/Savings on October 13th each year; if October 13th lands on a weekend or non-business day, the transfer will occur on the next business day. In addition to the automatic yearly transfer, one additional withdrawal between October to October is available. If more than the yearly transfer and the one additional withdrawal between October to October is needed, the Holiday Club will be closed for a full 12-months (from the time of closure) before it will be eligible for re-opening.

5 Fees apply to Business Checking Accounts.

Member eligibility required. All savings and checking rates are variable and may change after the account is opened. Fees may reduce earnings on the account. For CDs/Certificates of Deposit and IRAs a penalty will be imposed for early withdrawal. All rates effective as of 03/01/2026 and are subject to change without notice.

Essentia Office

Miller Dwan Building Lobby

502 E 2nd St. Bldg.C Ste.L8412

Duluth, MN 55805

Phone

(218) 740-2244